With the introduction of new regulations, traceability and auditability have become crucial elements in any data analysis task. BCBS 239, set by the Basel Committee on Banking Supervision, are global standards known as RDARR (Risk Data Aggregation and Risk Reporting). These guidelines are crucial for enhancing the stability of the global banking system by ensuring robust processes for collecting, aggregating, and reporting risk-related data. Central to BCBS 239’s objectives are the principles of traceability and accuracy, ensuring that banks maintain the highest standards in their risk data management.

In the regulation BCBS 239, Principle 3 speaks most directly to data lineage. This principle requires banks to document and explain their risk data aggregation methods and ensure the accuracy and reliability of the data used. It emphasizes the importance of traceability and auditability, requiring banks to maintain a precise lineage of every data point used for internal and external reporting.

Atoti inherently serves as an RDARR/BCBS 239 solution, enabling firms to create robust risk reporting systems from the ground up. Atoti naturally aligns with RDARR requirements, as its development process begins with a meticulous definition of the data journey, ensuring compliance with these critical regulatory standards.

Atoti is tailored for the unique demands of the financial industry, designed to easily adapt to regulatory requirements while optimizing the ability to explore, explain, optimize and adjust data. As an in-memory solution, Atoti achieves this differently from other solutions that simply record every change in their databases. In this article, we will explore how this distinction allows our customers to achieve perfect data traceability using Atoti.

The challenges of keeping a traceable record of risk data

Most risk analysis platforms offer traceability in a straightforward but notably inefficient manner; as they make data available for analysis, they create and store a record of every data point that enters the system at every level of aggregation they support.

The static nature of this approach presents several challenges:

- It shows the start and end points, but not the intermediate steps or how the data was processed along the way.

- If a calculation is flawed or an intermediary step is missing, it becomes difficult or even impossible to fully explain any anomalies.

- Maintaining an ever-expanding record of data becomes increasingly difficult to manage and analyze as the dataset continues to grow.

The Atoti edge: Tracing data lineage in the most efficient way

Solutions built with Atoti inherently comply with RDARR regulations because their development begins with defining the data journey. Unlike most other analytics platforms, Atoti separates business logic from data queries. This gives the platform unparalleled flexibility and provides a direct and reliable way to ensure data traceability. Instead of recording data at every processing stage, Atoti keeps track of two key elements: the original “raw” data and the set of calculations applied to it.

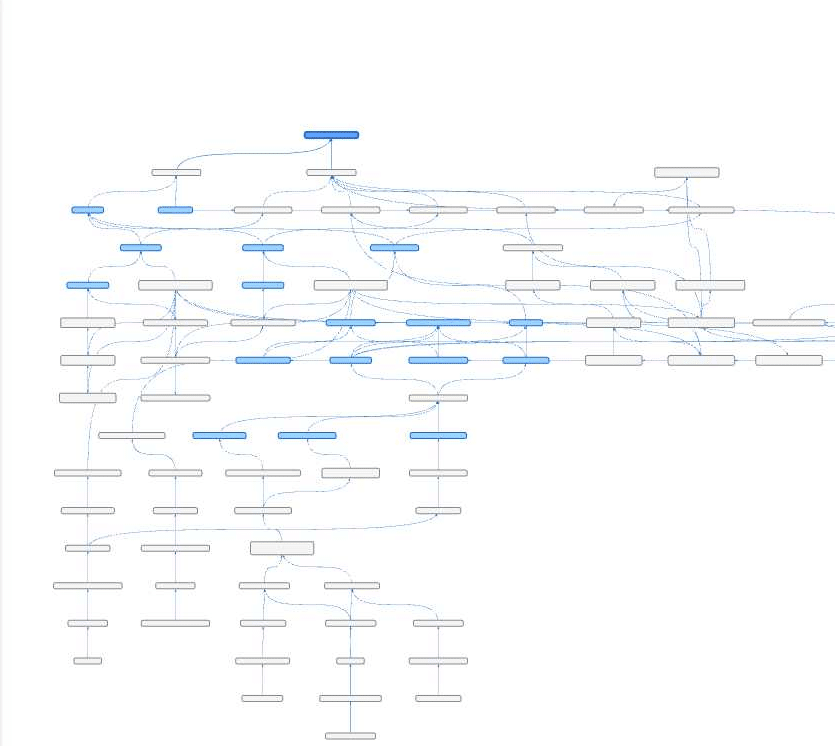

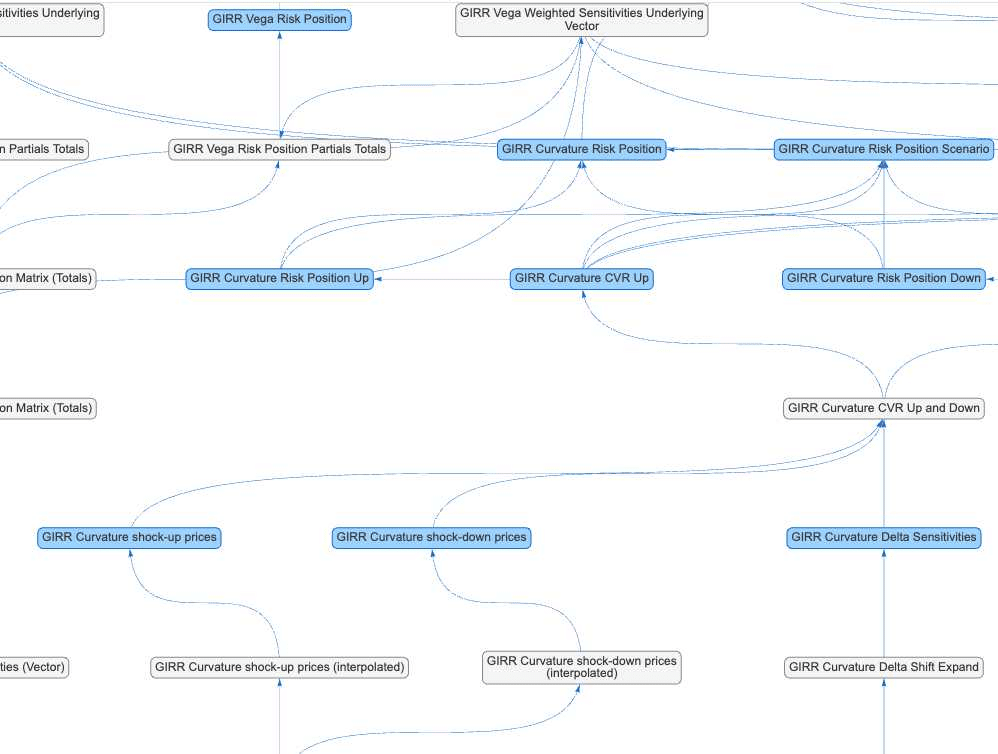

On the admin side, Atoti features a practical and intuitive tool that offers detailed and complete lineage of every data point, from the moment the data is entered into Atoti through all subsequent calculations. It acts as both an auditing and a diagnostic tool, showing the precise lineage of any data point entering Atoti and making it easier to locate and resolve any issue.

Atoti traces data lineage precisely and comprehensively in a way that is easy to explore with tools that are completely integrated into Atoti and available out-of-the-box.

One click lets you zoom in on any part of the data journey from the admin panel.

Alternatively, you can reverse the scenario: choose a particular trade within Atoti, and the platform can display a table with all the measures in the cube that it impacts.

The perfect data lineage of DirectQuery

DirectQuery is Atoti’s innovative tool that allows users to query data directly from third-party databases like Snowflake, AWS, BigQuery, DataBricks, ClickHouse, Apache Spark, and more. With DirectQuery, data traceability is streamlined, as there is no data duplication within Atoti’s datastore and no intermediation between the raw data and the results. This functionality ensures out-of-the-box compliance with BCBS 239 requirements by design.

Tracing adjustments and write-backs

Atoti also allows authorized end users to make real-time data adjustments on-the-fly, such as during end-of-day sign-offs. While these adjustments are usually minor and less frequent than updates from external source systems, they still require tracking.

To address this need, we have developed an optional Sign-Off module for Atoti. This module provides a precise, customizable approval workflow along with a dedicated audit trail, which is stored in a separate persistent database. Given that manual adjustments are typically minimal, this feature can be implemented with a discrete hardware footprint.

Going Beyond ‘Good Enough’ – The Best Technology for Best Practices

Atoti efficiently addresses additional BCBS 239 requirements, ensuring comprehensive compliance and superior performance. For instance, Principle 4 emphasizes the need to analyze data across various hierarchies to accurately identify risk exposures and concentrations. This task, often challenging for many analytics platforms due to performance issues, is where Atoti excels, handling heavy-duty, large-scale data analysis with ease.

Principle 6 mandates that banks must be able to handle a wide range of spontaneous risk management reporting requests, especially during stress or crisis situations. This requires a highly responsive and flexible analytics platform capable of aggregating data from multiple sources, which is precisely what Atoti is designed for. With DirectQuery, relevant data from any point in time can be accessed and analyzed without delay. In contrast, other solutions may be limited to a single database and struggle to quickly access the additional data needed to respond to regulatory inquiries.

Conclusion

Atoti stands out as a comprehensive and efficient solution for meeting the stringent requirements of BCBS 239. Its unique approach to data traceability, flexible reporting capabilities, and robust compliance features make it an invaluable tool for the financial industry. By separating business logic from data queries and leveraging powerful tools like DirectQuery and the Sign-Off module, Atoti ensures precise, reliable, and real-time data management. This allows financial institutions to not only comply with regulatory standards but also to enhance their risk management and reporting capabilities, ultimately staying competitive in a demanding industry.

- Operates at every level of granularity without sacrificing performance

- Rapid integration with existing bank-wide data infrastructure

- Full calculation transparency to answer any regulatory inquiries and investigations

- Flexible reporting with drill-down and slicing/dicing that enables explanation/investigation

- Out-of-the-box compliance with Risk Data Aggregation and Risk Reporting (RDARR) standards